Understanding the pricing for accounting software can be confusing. Different providers offer various plans and features.

For businesses of all sizes, finding the right accounting software is crucial. It helps manage finances, track expenses, and ensure compliance. But with many options available, determining the best choice can be daunting. Prices vary based on features, user numbers, and support services.

Knowing what to expect can save time and money. This blog will explore the different pricing models, helping you choose the best fit for your needs. Whether you run a small business or a large enterprise, understanding pricing is essential. Let’s dive into the details and make informed decisions about accounting software.

Introduction To Accounting Software Pricing

Accounting software pricing varies based on features and user needs. Basic packages are often affordable. Advanced options can be more costly.

Choosing the right accounting software is vital for businesses. Pricing plays a significant role in this decision. Understanding the cost helps in making an informed choice. It ensures the software meets both needs and budget.Importance Of Cost In Decision Making

The cost of accounting software impacts the overall budget. Businesses must allocate funds wisely. Spending too much can strain resources. Spending too little may result in missing features. Therefore, balancing cost and functionality is crucial.Factors Influencing Prices

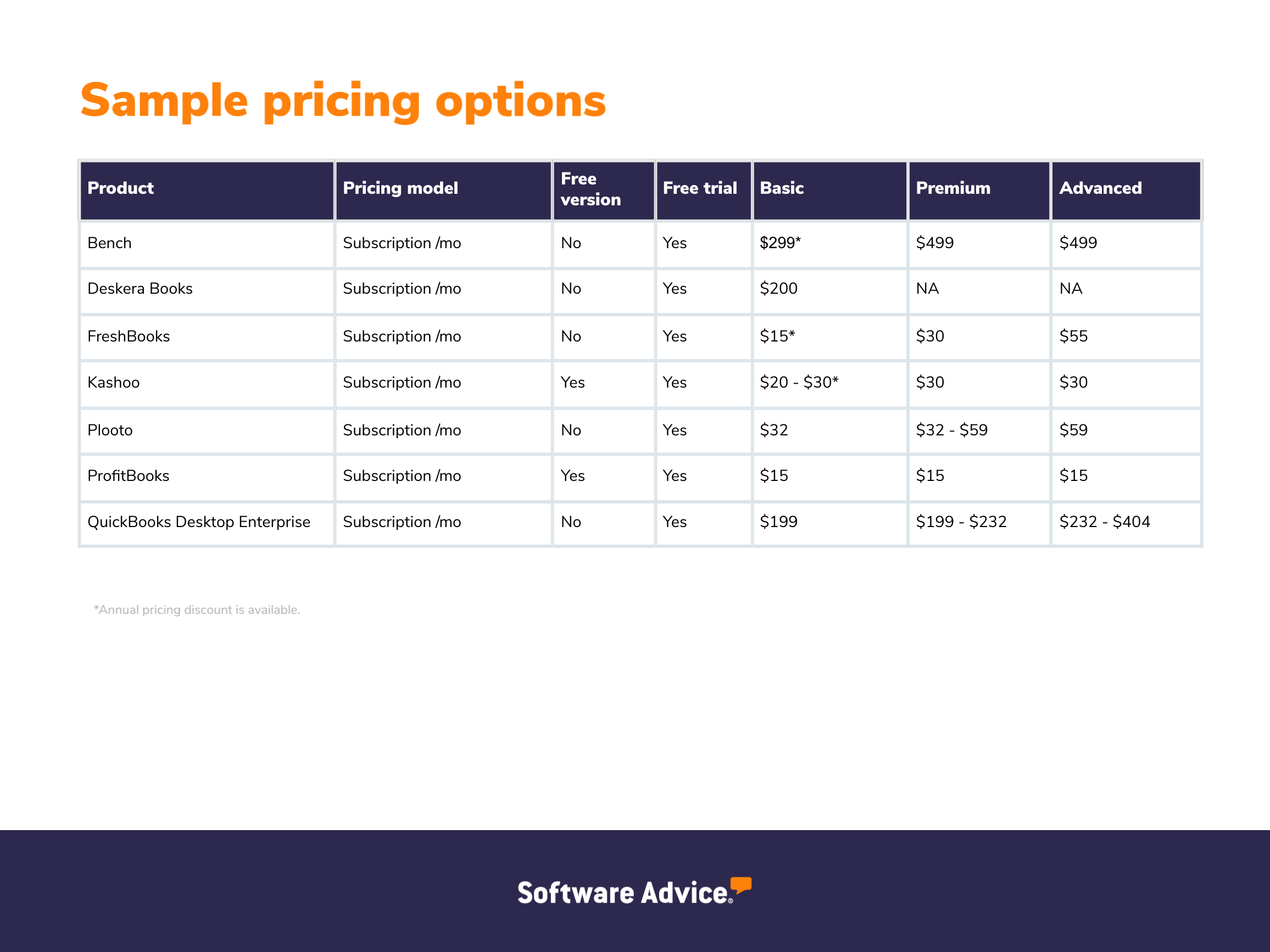

Several factors affect the pricing of accounting software. Firstly, the features offered. More features usually mean higher prices. Basic versions cost less but offer fewer functions. Secondly, the number of users. Software for many users is more expensive. Single-user software is cheaper. Thirdly, the type of support provided. Premium support plans raise the cost. Basic support plans are more affordable. Lastly, the payment model. Subscriptions might seem cheaper monthly but add up yearly. One-time purchases can be costly upfront but cheaper in the long run. Understanding these factors helps in choosing the right software. Balancing these elements ensures the best value for money. “`

Credit: www.betterbuys.com

Types Of Accounting Software

Choosing the right accounting software can be a daunting task. There are several types of accounting software available, each with its own pros and cons. Understanding these types can help you make an informed decision. Let’s dive into the two main types: cloud-based solutions and on-premise software.

Cloud-based Solutions

Cloud-based accounting software is hosted online. Users access it through a web browser. This type of software is becoming more popular. It offers many benefits, such as:

- Accessibility from anywhere with an internet connection

- Automatic updates and backups

- Reduced need for IT infrastructure

- Scalability to grow with your business

Cloud-based solutions often work on a subscription model. You pay a monthly or yearly fee. This makes budgeting easier. Examples of popular cloud-based accounting software include QuickBooks Online and Xero.

On-premise Software

On-premise accounting software is installed locally on your company’s computers. This type has its own set of advantages, including:

- Full control over your data

- No need for internet access to use the software

- Customizable according to your needs

On-premise solutions usually require a one-time purchase or a licensing fee. They often need dedicated IT support for maintenance. Examples of on-premise software are Sage 50 and Microsoft Dynamics GP.

| Feature | Cloud-Based | On-Premise |

|---|---|---|

| Accessibility | Anywhere with internet | Only on local machines |

| Cost | Subscription-based | One-time purchase |

| Updates | Automatic | Manual |

| IT Infrastructure | Minimal | Significant |

Weigh the pros and cons carefully. Choose the one that best fits your needs.

Free Accounting Software Options

Many small businesses and startups look for cost-effective solutions for their accounting needs. Free accounting software options can provide the essential tools without the hefty price tag. These options can be a great starting point for managing finances efficiently.

Features Of Free Software

Free accounting software often includes basic features to meet your business needs. You can expect tools for invoicing, expense tracking, and financial reporting. Some software may also offer integrations with bank accounts and payment processors. This helps streamline your financial processes.

Many free options come with user-friendly interfaces. This makes it easier for non-accountants to navigate and use the software. Customer support is usually available through forums or email. This ensures you get the help you need without extra costs.

Pros And Cons

Free accounting software comes with several benefits. First, it reduces costs for small businesses. You can manage your finances without spending money on software. Second, it provides essential features to run your business efficiently.

There are also some drawbacks. Free software often has limited features compared to paid versions. This might not be enough for growing businesses. Security features might also be basic, which could be a concern. Lastly, customer support might be limited to forums or community help.

Credit: www.jaz.ai

Low-cost Accounting Software

Low-cost accounting software offers a great way to manage finances on a budget. Small businesses and freelancers benefit from these affordable solutions. Many options provide essential features without breaking the bank. This section explores some of the best low-cost accounting software options available.

Affordable Paid Solutions

Many low-cost accounting software solutions come with a small monthly fee. These paid options often include more features than free versions. They provide better support and more frequent updates. Examples include FreshBooks, Xero, and QuickBooks Online. These tools offer great value for their price. They are ideal for small businesses and startups.

Key Benefits

Low-cost accounting software offers many key benefits. First, it helps businesses save money. Lower costs mean more resources for other needs. Second, these tools are easy to use. They often have user-friendly interfaces. This makes them accessible to non-accountants. Third, they offer essential features. This includes invoicing, expense tracking, and financial reporting. Finally, low-cost options often have good customer support. This ensures users get help when they need it.

Mid-range Pricing Options

Choosing the right accounting software can be overwhelming. Mid-range pricing options offer a balance between cost and features. They cater to small and medium businesses looking for robust tools without breaking the bank. Let’s explore some popular mid-range software and the advanced features they offer.

Popular Mid-range Software

Several accounting software options fall within the mid-range price bracket. QuickBooks Online is a popular choice. It offers comprehensive features for growing businesses. Xero is another favorite, known for its user-friendly interface. FreshBooks is ideal for service-based businesses, providing excellent invoicing tools.

Advanced Features Included

Mid-range software often includes advanced features. These go beyond basic accounting tasks. For instance, QuickBooks Online includes inventory management. Xero offers multi-currency support and strong integration capabilities. FreshBooks provides time-tracking and project management tools.

These features help businesses streamline operations. They save time and reduce errors. Advanced reporting tools are also common. They provide insights into business performance. Customizable dashboards allow users to see key metrics at a glance.

Credit: www.softwareadvice.com

Enterprise-level Accounting Software

Enterprise-level accounting software is designed for large organizations. These solutions handle complex financial processes and massive data volumes. They integrate seamlessly with other enterprise systems, providing a unified platform for all financial operations. Their features cater to the needs of large-scale businesses, offering robust security and compliance measures.

High-end Solutions

High-end accounting software offers advanced tools for financial management. These tools include real-time analytics, custom reporting, and automated workflows. They help streamline accounting processes, reducing manual tasks and errors. Such solutions support multiple currencies and international financial regulations.

The software also provides scalable options. Organizations can expand their usage as they grow. This flexibility ensures the software can handle increasing data and user numbers. It also includes high-level support and training, ensuring smooth implementation and operation.

Comprehensive Capabilities

Enterprise-level software boasts comprehensive capabilities. It includes modules for accounts payable, accounts receivable, and general ledger. The software offers detailed audit trails and compliance features, essential for large organizations.

Additionally, it supports integration with other enterprise systems. This includes ERP, CRM, and inventory management systems. These integrations create a unified platform, enhancing data consistency and accessibility. The software also provides advanced security features, protecting sensitive financial data.

Subscription Vs. One-time Purchase

Choosing the right accounting software can be a challenge. An important decision is whether to go for a subscription or a one-time purchase. Each option has its pros and cons. Understanding these can help you make the best choice for your business.

Cost Comparison

The initial cost is a big factor. A one-time purchase usually has a higher upfront cost. But, you only pay once. This can be a good option if you have the budget.

With a subscription, you pay a smaller fee every month or year. This can be easier on your budget. But, over time, it can add up. Here is a simple table to compare:

| Cost Type | One-Time Purchase | Subscription |

|---|---|---|

| Initial Cost | High | Low |

| Ongoing Cost | None | Monthly/Yearly |

| Total Cost Over 3 Years | Fixed | Variable |

Long-term Value

Think about the long-term value. A one-time purchase can save you money over many years. But, it might not include updates or support. If you want the latest features, you might have to pay extra.

A subscription often includes updates and support. You always have the latest features. This can be a big advantage. Over time, the cost can be higher, but the value might also be higher.

Here are some points to consider:

- How long do you plan to use the software?

- Do you need regular updates?

- Is customer support important to you?

- What is your budget for software?

Answering these questions can help you decide which option offers the best value for your needs.

Tips For Choosing The Right Software

Choosing the right accounting software can be challenging. With so many options available, it’s crucial to find one that fits your specific needs. Here are some essential tips to help you make the right choice.

Assessing Business Needs

First, determine what your business needs from accounting software. Do you need basic bookkeeping or advanced financial reporting? Smaller businesses might need simple invoicing and expense tracking. Larger enterprises might require features like payroll processing and inventory management. Understanding your needs will help narrow down your options.

Budget Considerations

Next, consider your budget. Accounting software comes in various price ranges. Some are free with basic features, while others require a monthly or annual subscription. Evaluate the cost against the features offered. Ensure the software provides value for your investment. Remember, the cheapest option might not always be the best fit for your business.

Frequently Asked Questions

What Is The Cost Of Accounting Software?

The cost of accounting software varies. It ranges from free to several hundred dollars per month. Pricing depends on features, user count, and business size.

Are There Free Accounting Software Options?

Yes, there are free accounting software options available. Some popular free options include Wave, ZipBooks, and GnuCash. They offer basic features suitable for small businesses.

How Do Pricing Tiers Work In Accounting Software?

Pricing tiers in accounting software are based on features and user count. Basic plans offer essential features, while premium plans include advanced tools. Businesses can choose based on their needs.

Is Accounting Software Pricing Based On Users?

Yes, many accounting software providers price their plans based on the number of users. More users typically mean higher costs. Some software offers unlimited users at a fixed price.

Conclusion

Choosing the right accounting software depends on your business needs. Consider your budget and required features. Compare different options before deciding. Look for software that offers good value. Keep future growth in mind. Affordable software can still meet your needs.

Take advantage of free trials. This helps you test before you buy. Remember, the right software can save you time and money. Make an informed choice to boost your business efficiency.

Leave a Reply