Managing finances is crucial for small businesses. The right accounting software can simplify this task.

Running a small business involves juggling many responsibilities. One of the most important is keeping your finances in order. Accounting software helps you track expenses, manage invoices, and ensure tax compliance. For small business owners, finding the best accounting software can save time and reduce stress.

With many options available, it’s essential to choose one that fits your needs. In this blog post, we’ll explore some of the top accounting software for small businesses. This guide will help you make an informed decision, ensuring your business runs smoothly. Let’s dive in and find the perfect solution for your accounting needs.

Quickbooks Online

QuickBooks Online is a highly popular accounting software for small businesses. This cloud-based solution offers a wide range of features and capabilities. It helps business owners manage their finances with ease and efficiency. Below, we explore the key features, pros, and cons of QuickBooks Online.

Features

- Cloud-based access: Access your financial data from anywhere, anytime.

- Invoicing: Create, send, and track professional invoices.

- Expense tracking: Monitor and categorize expenses easily.

- Bank reconciliation: Automatically match transactions with your bank statements.

- Reporting: Generate various financial reports quickly.

- Third-party integrations: Integrates with many popular apps and services.

Pros And Cons

| Pros | Cons |

|---|---|

| Easy to use | Monthly subscription fees |

| Comprehensive features | Learning curve for new users |

| Cloud-based accessibility | Limited customer support options |

| Automated tasks | Occasional sync issues with banks |

Freshbooks

FreshBooks is a popular accounting software designed for small businesses. It offers a user-friendly interface and a range of features to help manage finances. Whether you’re a freelancer, consultant, or small business owner, FreshBooks can simplify your accounting tasks.

Features

FreshBooks comes packed with a variety of features to streamline your accounting processes:

- Invoicing: Create professional invoices quickly and easily.

- Expense Tracking: Track your business expenses and manage receipts.

- Time Tracking: Log hours worked and bill clients accordingly.

- Project Management: Manage projects and collaborate with your team.

- Payments: Accept online payments from clients.

- Reporting: Generate financial reports to gain insights into your business.

Pros And Cons

| Pros | Cons |

|---|---|

| Easy to use | Limited customization options |

| Excellent customer support | Higher cost for advanced features |

| Mobile app available | Limited integrations with other software |

| Automated reminders | No inventory management |

FreshBooks is an excellent choice for small businesses. It helps manage finances efficiently. Try it to see how it fits your needs.

Xero

Xero is a popular accounting software for small businesses. It offers a wide range of features to streamline your financial tasks. This cloud-based platform is user-friendly and provides real-time updates. Here’s a closer look at Xero’s features, pros, and cons.

Features

- Invoicing: Create and send invoices quickly.

- Bank Reconciliation: Connect your bank accounts for automatic updates.

- Expense Tracking: Easily track and manage expenses.

- Financial Reporting: Generate detailed financial reports.

- Inventory Management: Keep track of inventory levels and costs.

- Multi-Currency: Handle transactions in multiple currencies.

These features make Xero a comprehensive tool for managing your business finances.

Pros And Cons

| Pros | Cons |

|---|---|

|

|

Xero’s pros make it a strong choice for small businesses. Yet, consider the cons before making a decision.

Zoho Books

Zoho Books is an excellent accounting software that caters to small businesses. It provides a variety of features to streamline financial processes and ensure compliance. Zoho Books is known for its user-friendly interface and affordability, making it a popular choice for startups and small business owners.

Features

Zoho Books offers a wide range of features to help manage your business finances effectively:

- Invoicing: Create and send professional invoices.

- Expense Tracking: Record and monitor expenses.

- Bank Reconciliation: Match your bank transactions with your records.

- Inventory Management: Keep track of your inventory levels and orders.

- Project Management: Manage projects and track billable hours.

- Multi-Currency Support: Handle transactions in different currencies.

- Automation: Automate repetitive tasks to save time.

Pros And Cons

Zoho Books has its advantages and disadvantages:

| Pros | Cons |

|---|---|

|

|

Wave

Wave is a popular accounting software designed for small businesses. It offers a range of features tailored to help entrepreneurs manage their finances efficiently. Its user-friendly interface and affordability make it a top choice for many.

Features

- Invoicing: Create and send professional invoices quickly.

- Accounting: Track income and expenses with ease.

- Receipts: Scan and organize receipts effortlessly.

- Payroll: Manage employee payments and tax filings.

- Reports: Generate financial statements and reports.

- Bank Connections: Link your bank account for automatic updates.

Pros And Cons

| Pros | Cons |

|---|---|

| Free to use | No phone support |

| Easy to navigate | Limited integrations |

| Comprehensive features | Occasional sync issues |

| Professional invoicing | Payroll not available in all states |

Wave is a solid choice for small businesses with tight budgets. Its invoicing and accounting features are robust and user-friendly. The software is free, but additional services like payroll have costs.

Consider Wave if you need a simple yet effective accounting solution. It offers many features without hidden fees.

Sage Business Cloud Accounting

Sage Business Cloud Accounting is a popular choice among small businesses. It offers a range of features that simplify financial management. Designed with small business owners in mind, it provides tools to handle various accounting tasks efficiently.

Features

- Invoicing: Create and send professional invoices quickly.

- Expense Management: Track and categorize expenses with ease.

- Bank Reconciliation: Automatically match transactions with your bank statements.

- Financial Reporting: Generate detailed reports to monitor your business performance.

- Multi-currency Support: Handle transactions in different currencies without hassle.

- Cloud-based: Access your data anytime, anywhere.

Pros And Cons

| Pros | Cons |

|---|---|

| Easy to use interface | Limited customization options |

| Accessible from any device | Can be expensive for larger teams |

| Strong customer support | Learning curve for advanced features |

| Secure and reliable | Occasional slow performance |

Sage Business Cloud Accounting stands out with its user-friendly features. It’s ideal for small businesses needing straightforward accounting solutions. The cloud-based access ensures flexibility, while the robust support system provides peace of mind. Despite some limitations, it remains a top contender in the accounting software market.

Kashoo

Kashoo is a popular accounting software designed for small businesses. It offers a user-friendly interface and efficient tools. Kashoo helps business owners manage their finances with ease. Let’s dive into its features, pros, and cons to see why it’s a great choice.

Features

- Automatic Bank Feeds: Kashoo connects to your bank and imports transactions automatically.

- Invoicing: Create and send professional invoices quickly.

- Expense Tracking: Easily track and categorize your expenses.

- Multi-Currency Support: Handle transactions in various currencies.

- Reports: Generate financial reports like profit and loss, balance sheet, and more.

- Mobile App: Access your finances on the go with Kashoo’s mobile app.

Pros And Cons

| Pros | Cons |

|---|---|

| Easy to use interface | Limited integrations |

| Affordable pricing | Basic reporting features |

| Good customer support | No payroll features |

| Automatic transaction categorization | Limited advanced features |

Kashoo provides great value for small businesses. It simplifies accounting tasks and helps manage finances effectively.

Kashflow

Choosing the right accounting software is crucial for small businesses. KashFlow is a popular choice. It offers user-friendly features. Let’s dive into what makes KashFlow stand out.

Features

KashFlow offers a range of features designed for small businesses. Here are some key highlights:

- Invoicing: Create and send professional invoices easily.

- Expense Tracking: Keep track of all business expenses.

- Bank Reconciliation: Match bank transactions with your records.

- VAT Management: Simplify VAT returns and compliance.

- Payroll: Manage employee payroll effortlessly.

Pros And Cons

Understanding the pros and cons can help you make an informed decision. Here’s a breakdown:

| Pros | Cons |

|---|---|

| User-friendly interface | Limited integrations |

| Comprehensive reporting | Higher cost for advanced features |

| Strong customer support | Mobile app lacks some features |

| Cloud-based access | Learning curve for beginners |

KashFlow is a strong contender for small businesses. It offers essential features and ease of use. The pros often outweigh the cons, making it a viable option.

Oneup

OneUp is a popular accounting software designed specifically for small businesses. It offers a range of features that simplify accounting tasks and help manage finances efficiently. With OneUp, users can automate bookkeeping, track expenses, and generate financial reports with ease. Its user-friendly interface and robust functionalities make it a preferred choice for many small business owners.

Features

- Automated Bookkeeping: OneUp automatically categorizes transactions from bank accounts.

- Invoice Management: Create and send professional invoices easily.

- Expense Tracking: Track expenses and match them with bank transactions.

- Inventory Management: Monitor stock levels and manage inventory efficiently.

- Financial Reporting: Generate detailed financial reports and insights.

- CRM Integration: Integrate with CRM to manage customer relationships.

- Mobile App: Access your accounting data on the go with the mobile app.

Pros And Cons

| Pros | Cons |

|---|---|

|

|

Zipbooks

ZipBooks is a popular accounting software tailored for small businesses. It offers a user-friendly interface, making accounting tasks easy for non-accountants. With ZipBooks, manage invoicing, track expenses, and generate financial reports effortlessly.

Features

- Invoicing: Create and send professional invoices quickly.

- Expense Tracking: Categorize and monitor your expenses.

- Financial Reporting: Generate detailed reports to understand your business finances.

- Bank Reconciliation: Match your transactions with bank statements.

- Time Tracking: Track time spent on projects for accurate billing.

- Client Management: Maintain a database of your clients with ease.

Pros And Cons

| Pros | Cons |

|---|---|

|

|

Frequently Asked Questions

What Is The Best Accounting Software For Small Businesses?

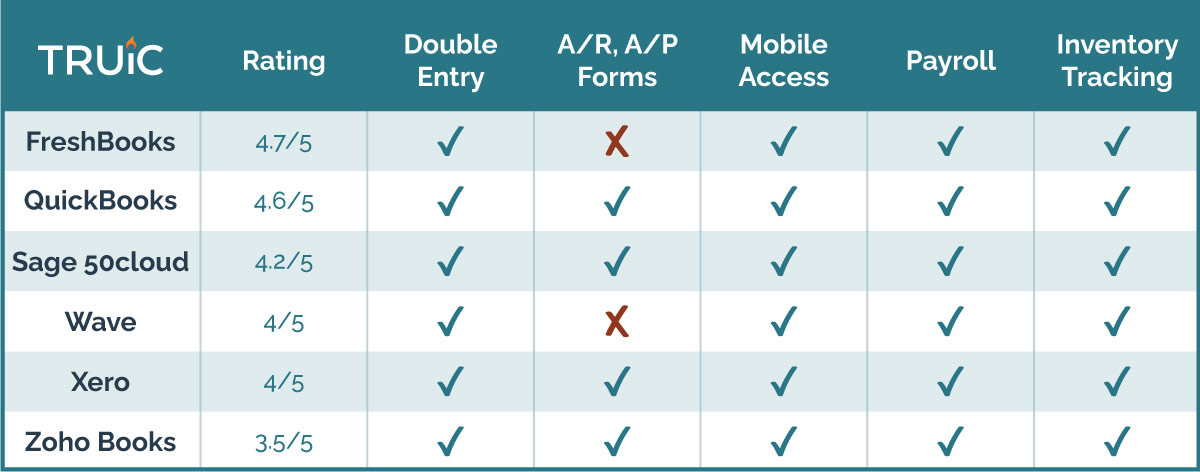

The best accounting software for small businesses depends on your needs. QuickBooks, FreshBooks, and Xero are highly recommended. They offer user-friendly interfaces, robust features, and good customer support.

How Does Accounting Software Benefit Small Businesses?

Accounting software streamlines financial management. It automates invoicing, expense tracking, and reporting. This saves time and reduces errors. It also helps with tax preparation and compliance.

Is Cloud-based Accounting Software Secure?

Yes, cloud-based accounting software is secure. It uses encryption to protect data. Regular backups ensure data is not lost. Always choose reputable providers with strong security measures.

Can Accounting Software Handle Payroll?

Yes, many accounting software solutions handle payroll. QuickBooks and Xero offer integrated payroll features. They automate salary calculations, tax deductions, and direct deposits.

Conclusion

Choosing the best accounting software for your small business is crucial. It saves time, reduces errors, and boosts efficiency. Evaluate your needs and budget carefully. Look for features that match your business. Consider user reviews and support options. A good software can streamline your accounting tasks.

Making an informed choice leads to better financial management. Start exploring options today and make your decision wisely. Your business’s future financial health depends on it.

Leave a Reply