Accounting software is essential for managing finances efficiently. It simplifies tasks and ensures accuracy.

In today’s digital age, businesses need reliable accounting tools. These tools help track expenses, manage invoices, and generate reports. Choosing the right software can save time and reduce errors. It can also provide valuable insights into your financial health. With so many options available, finding the best fit can be challenging.

Whether you’re a small business owner or a large corporation, the right accounting software can make a big difference. It can streamline your processes and improve your bottom line. In this blog post, we’ll explore the best accounting software options. We’ll look at their features, benefits, and how they can help your business thrive.

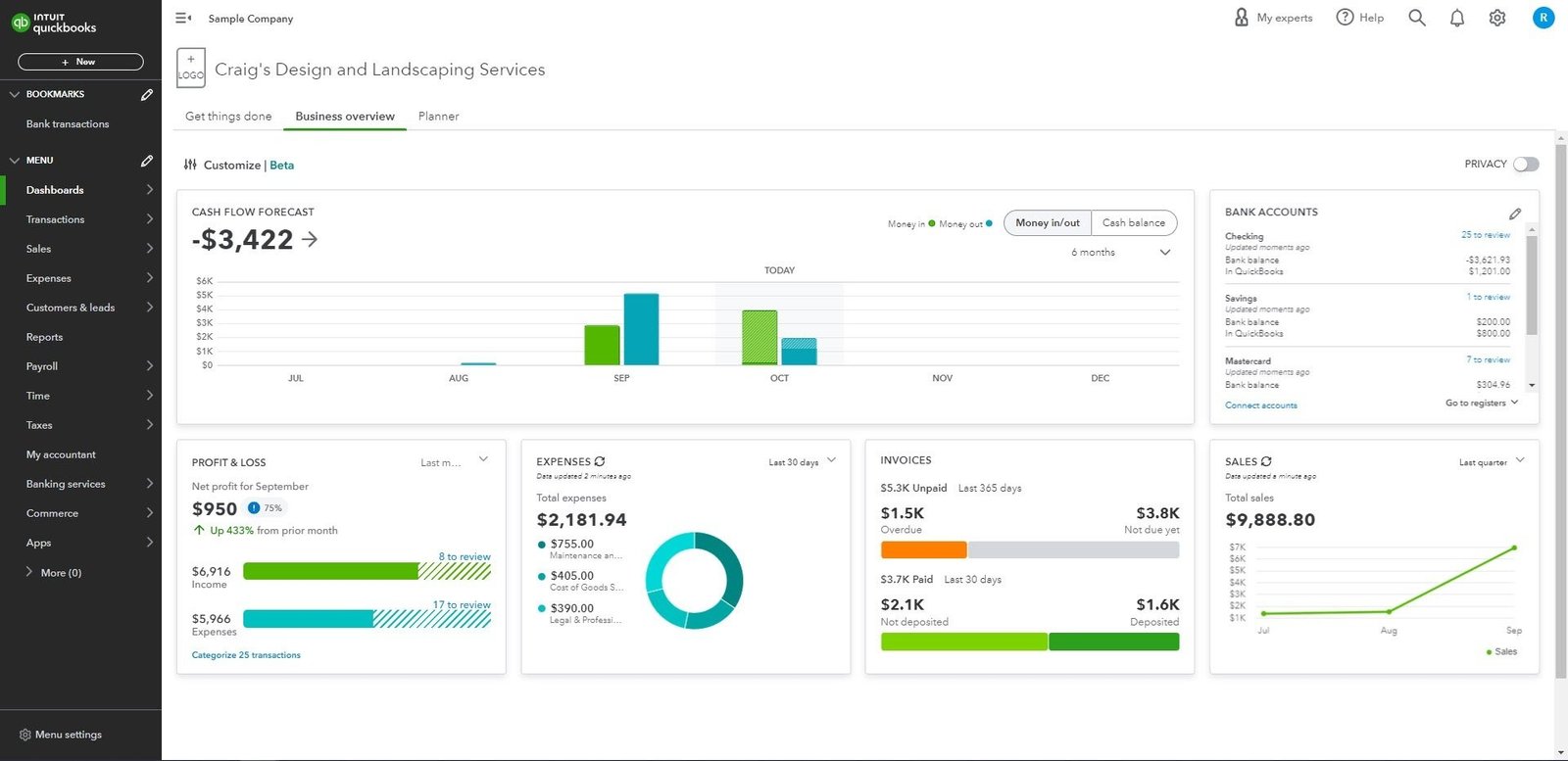

Quickbooks Online

QuickBooks Online is a popular accounting software for small to mid-sized businesses. It offers a range of features that simplify bookkeeping and financial management. Many businesses choose QuickBooks Online for its ease of use and comprehensive tools.

Key Features

QuickBooks Online provides many features to streamline accounting tasks. Automated invoicing helps you save time. The software also offers expense tracking, making budgeting easier. You can connect your bank accounts to keep track of transactions. Inventory management is another useful feature. QuickBooks Online also supports payroll processing. This ensures timely and accurate salary payments.

Pros And Cons

QuickBooks Online has several advantages. The user interface is intuitive and easy to navigate. Cloud-based access allows you to manage finances from anywhere. Integration with other business tools is seamless. Regular updates keep the software current and secure.

There are some downsides. The pricing can be high for small businesses. Some users find customer support lacking. Advanced features may require additional fees. Learning all the functions takes time and effort.

Pricing

QuickBooks Online offers various pricing plans. The Simple Start plan is the most basic and affordable. The Essentials plan includes more features and is mid-priced. The Plus plan offers advanced tools at a higher cost. Each plan offers a 30-day free trial. This helps you decide which plan fits your needs.

Credit: quickbooks.intuit.com

Xero

Xero is a popular accounting software designed for small to medium-sized businesses. It offers a range of features that make managing finances easier. With Xero, you can handle invoicing, bank reconciliation, and payroll efficiently.

Key Features

- Invoicing: Create and send professional invoices quickly.

- Bank Reconciliation: Link your bank accounts and reconcile transactions easily.

- Payroll: Manage your payroll and stay compliant with regulations.

- Expense Tracking: Track and categorize expenses for better financial insights.

- Multi-Currency: Handle transactions in multiple currencies seamlessly.

Pros And Cons

| Pros | Cons |

|---|---|

|

|

Pricing

Xero offers three main pricing plans:

- Early Plan: $12/month – Best for sole traders and new businesses.

- Growing Plan: $34/month – Suitable for growing small businesses.

- Established Plan: $65/month – Ideal for established businesses needing advanced features.

Each plan includes a 30-day free trial. No credit card required.

Freshbooks

FreshBooks is a cloud-based accounting software designed for small businesses and freelancers. It offers a user-friendly interface and various features to simplify bookkeeping tasks. With FreshBooks, you can manage invoices, track expenses, and handle payments effortlessly.

Key Features

FreshBooks provides several standout features for users:

- Invoice creation and customization

- Expense tracking and categorization

- Time tracking for projects

- Payment processing

- Financial reporting

Pros And Cons

Understanding the pros and cons helps in decision-making:

Pros:

- Easy to use interface

- Mobile app availability

- Excellent customer support

- Integration with other tools

Cons:

- Limited features in the basic plan

- Higher cost for advanced features

- Customization options could be better

Pricing

FreshBooks offers several pricing plans to suit different needs:

- Lite Plan: $15 per month

- Plus Plan: $25 per month

- Premium Plan: $50 per month

- Select Plan: Custom pricing for larger businesses

Each plan includes a 30-day free trial, allowing users to test the software before committing.

Credit: bestaccountingsoftware.com

Wave

Wave is a popular accounting software designed for small businesses. It stands out due to its user-friendly interface and comprehensive features. With Wave, managing finances becomes simpler and more efficient.

Key Features

- Invoicing: Create professional invoices in minutes.

- Expense Tracking: Easily track your expenses and receipts.

- Bank Reconciliation: Sync your bank accounts for seamless reconciliation.

- Reports: Generate detailed financial reports with ease.

- Payroll: Manage payroll for your employees with integrated tools.

Pros And Cons

| Pros | Cons |

|---|---|

| Free for basic accounting needs | Limited advanced features |

| User-friendly interface | Customer support can be slow |

| Comprehensive financial reports | Payroll services are paid |

| Integrates with bank accounts | Limited integrations with other software |

Pricing

- Free Plan: Includes invoicing, accounting, and receipt scanning.

- Payroll Services: Starts at $20 per month, plus $6 per employee.

Zoho Books

Zoho Books is a comprehensive accounting software designed for small and medium-sized businesses. It offers a wide range of features that help manage finances, automate business workflows, and work collectively across departments. Zoho Books is known for its user-friendly interface, making it a favorite for many business owners and accountants.

Key Features

- Automated Banking: Connect your bank accounts and reconcile transactions automatically.

- Expense Tracking: Track your expenses effortlessly and categorize them for better insights.

- Invoicing: Create and send professional invoices with customizable templates.

- Inventory Management: Manage your stock levels, track inventory, and ensure you never run out of products.

- Time Tracking: Track billable hours and integrate with projects for accurate billing.

- Multi-Currency Support: Handle transactions in multiple currencies with ease.

- Tax Management: Automate tax calculations and stay compliant with tax regulations.

Pros And Cons

| Pros | Cons |

|---|---|

|

|

Pricing

Zoho Books offers several pricing plans to cater to different business needs:

- Free Plan: Ideal for businesses with a turnover of less than $50,000 per year.

- Standard Plan: $20 per organization per month. Includes invoicing, expenses, and projects.

- Professional Plan: $50 per organization per month. Adds inventory and purchase orders.

- Premium Plan: $70 per organization per month. Includes advanced features like custom roles and workflows.

- Elite Plan: $150 per organization per month. Best for large businesses with advanced needs.

Zoho Books also offers a 14-day free trial for you to explore its features before committing to a plan.

Comparative Analysis

Choosing the right accounting software can be challenging. Different products offer different features and benefits. This comparative analysis will help you make an informed decision. We will look at key aspects like User Interface, Customer Support, and Integrations.

User Interface

The user interface is crucial. It affects how easily you can use the software. A good interface should be intuitive and easy to navigate.

- QuickBooks: Known for its clean and simple interface. Users appreciate its dashboard.

- FreshBooks: Offers a more visual and user-friendly design. Ideal for beginners.

- Zoho Books: Provides a customizable interface. It can be tailored to fit your needs.

Customer Support

Good customer support can save you time and stress. Quick responses and knowledgeable staff are essential.

- QuickBooks: 24/7 support through chat and phone. Extensive help articles.

- FreshBooks: Email and phone support during business hours. Helpful support team.

- Zoho Books: Offers email, phone, and chat support. Users rate it highly for response times.

Integrations

Integrations with other tools can improve workflow. They allow you to streamline your processes.

- QuickBooks: Integrates with over 650 apps. This includes payment processors and CRMs.

- FreshBooks: Supports integrations with popular tools like Slack and Shopify.

- Zoho Books: Works well with other Zoho apps and third-party applications.

Here is a summary table for a quick comparison:

| Feature | QuickBooks | FreshBooks | Zoho Books |

|---|---|---|---|

| User Interface | Clean and simple | Visual and user-friendly | Customizable |

| Customer Support | 24/7 support | Email and phone | Email, phone, and chat |

| Integrations | 650+ apps | Popular tools | Zoho and third-party apps |

Credit: bestaccountingsoftware.com

Frequently Asked Questions

What Is The Best Accounting Software For Small Businesses?

The best accounting software for small businesses often includes QuickBooks, Xero, and FreshBooks. These tools provide features like invoicing, expense tracking, and financial reporting.

How Much Does Accounting Software Cost?

The cost of accounting software varies. Basic plans start around $10 per month. More advanced plans can cost $60 or more monthly.

Can Accounting Software Handle Payroll?

Yes, many accounting software solutions like QuickBooks and Xero offer integrated payroll services. This simplifies managing employee salaries and taxes.

Is Accounting Software Secure?

Yes, reputable accounting software ensures data security with encryption and regular backups. Always choose software with strong security measures.

Conclusion

Choosing the best accounting software simplifies your financial tasks. Consider features, ease of use, and support. Match the software to your business size and needs. Research options carefully. Read reviews and try demos. The right choice saves time and prevents errors.

Invest in software that grows with your business. Your accounting will be easier and more efficient. Make an informed decision and enjoy smoother financial management.

Leave a Reply